FIA (Asia Derivative Conference) is an annual event consisting of a combination of networking sessions, talks, and discussions on the latest happenings in the financial market.

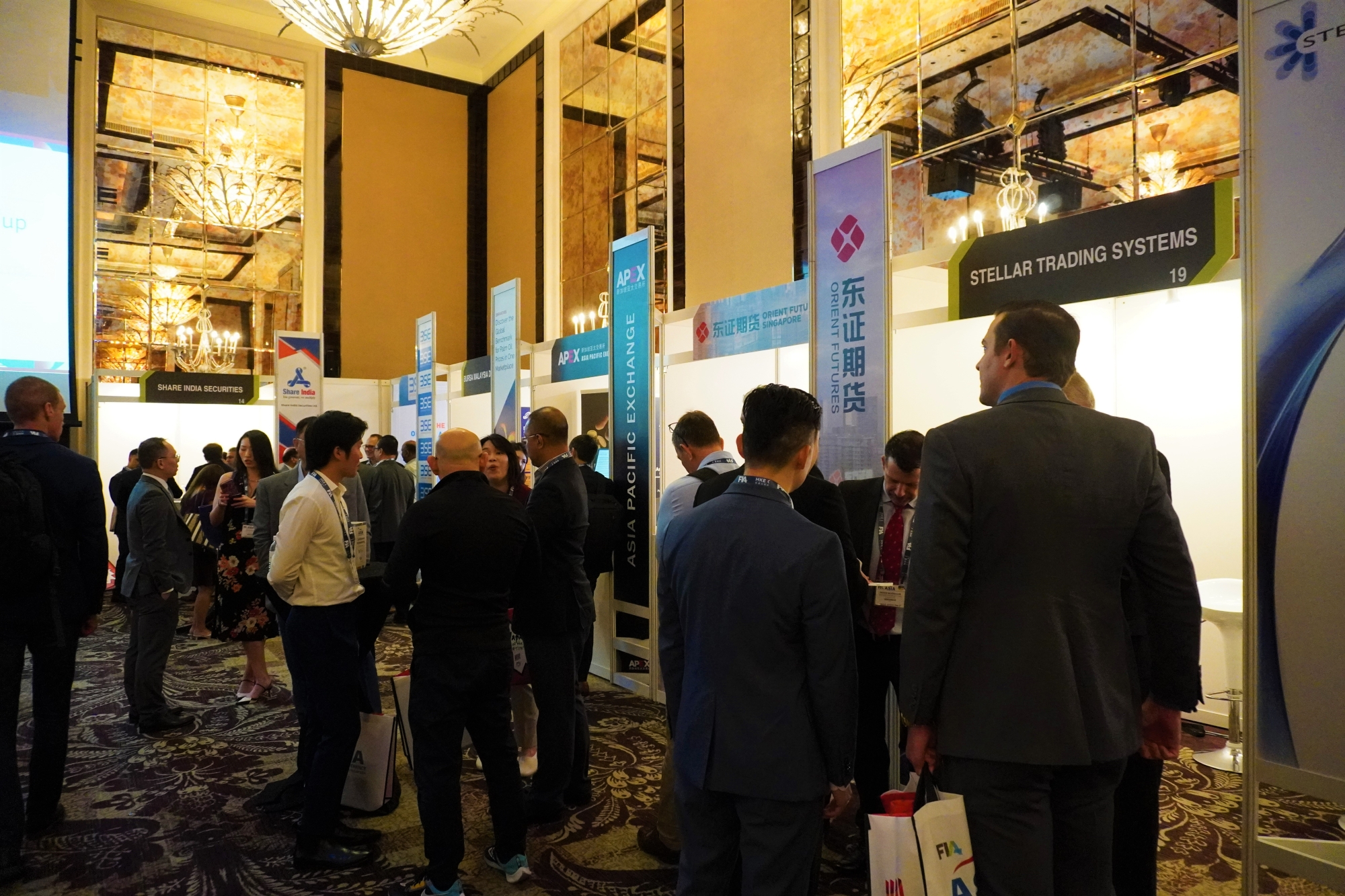

Since the outbreak of Covid-19, the event has been held online, however, from 29 November to 1 December 2022, the long-anticipated event was held in person at the St. Regis Singapore.

As a previous participant in 2019, Orient Futures Singapore was elated to reemerge from the online space into the scene. Above all, the firm continues to learn from our fellow counterparts and past experiences to provide better services in futures, forex, and derivatives services.

Topics of discussion for FIA 2022

Among the topics of discussion, Mr. Marcus Goi, our Chief Executive Officer is an honored guest that is invited to the panel discussion on “The Derivatives Landscape in China”.

He has managed to share the benefits and strengths of easing market access from China through regulations such as the Futures and Derivatives Law or the Qualified Foreign institutional investor / QFII scheme.

Mr. Marcus Goi said: “With the implementation of FDL, it has potential. However, along with the regulations, if an individual wants to trade onshore, it can be through an offshore outbound presence. In this case, Orient Futures Singapore as a Chinese-backed subsidiary might be the way.”

When considering investing in China through the qfi program, Marcus also explains that: “it is important to consider that for China to remain profitable in the derivatives and trade industry, it will have to open up to the world. This strategic direction will benefit the clients and the larger community. Eventually, clients will also be able to hedge their exposure overseas and perform hedging risks or other forms of trade.”

Regarding the system and feasibility of trade, Marcus continues: “geopolitics, differences of policies, rising interest by FED all create volatility. While that is good for brokerage firms, it is important to manage client risk and margin calls. How brokerages manage risk and liquidity is also crucial to safeguard the role of clearing members. And this boils down to calibrating the balance between the thin margins, risk, and liquidity.”

To elaborate on the risk management system implied from Marcus’s speech, Orient Futures Singapore would survey the information of relevant customers, pay close attention to customer trading behaviour, and prevent market risks or potential violations of laws and regulations in advance. This inbuilt process is jointly implemented by the client, the brokerage, and the exchange, contributing to a well-calibrated system. Through the tightly managed system, it is conducive to reducing market volatility and stabilizing product prices.

Apart from the derivatives landscape in China, other themes covered in the event include the impact of regulatory developments on the ETD industry, the next chapter in market technology, and various other topics which will be covered in the subsequent articles.

Futures and Derivatives Law:

The Law draws on international best practices while considering the main systems of some global derivatives markets. Through legislation, this law fills the gaps in some existing trading rules, and it will allow the future industry to be more standardized.

QFII Scheme:

On September 2022, China opened its financial and commodity markets further to foreign investors, in this scheme, 27 QFI tradable futures, and 18 QFI tradable options are made available. This scheme is also known to some as the qfii and rqfii scheme.

Parties involved in FIA 2022

The FIA community consists of primary members that are clearing members who hold customer funds or have contributed substantially to the safety and soundness of the market infrastructure.

At the event, many stakeholders were present including:

Exchange: SGX Group, CME Group, B3, Bursa Malaysia Derivatives

Platform Providers: CQG, TT, Stellar Trading Systems.

Brokerage: Orient Futures Singapore, NANHUA Singapore Pte Ltd, Share India Securities Limited

FIA’s Priorities and Key Issues

FIA provides support to the industry through advocacy and the development of best practices for the industry. Among the recent news, on Oct 2022, FIA also submitted several suggestions to the China Securities Regulatory Commission (CSRC) to better integrate the Futures and Derivatives Law. Some suggestions include the clarification of the “separate tier” futures settlement model set out in the Measures and a statutory definition of “program trading” to provide clarity to participants.

In a different aspect of the derivatives industry, energy is also discussed, Planta “said that while energy derivatives markets play an essential role for price discovery, measures to contain excessive volatility could help in improving the overall functioning of the markets”.

For more information, head to the Fin market Voice segment from FIA located here.

Start Trading With Orient Futures Singapore

Being an Overseas Intermediary of Shanghai International Energy Exchange (INE), Dalian Commodity Exchange (DCE), and Zhengzhou Commodity Exchange (ZCE), when foreign clients participate in internationalised futures contracts in these Chinese markets with us, they have direct access to trading, clearing, and settlement. Our parent company, Shanghai Orient Futures, is the largest broker in terms of aggregated volume across the five regulated exchanges in China.

Orient Futures Singapore also currently holds memberships at the Singapore Exchange (SGX), Asia Pacific Exchange (APEX), and ICE Futures Singapore (ICE SG).

We provide premium customer service at an affordable cost to all our clients. Our team will be there for you 24 hours on trading days to provide a one-stop portal for all your trades, with simple processes and an intuitive user interface that has low or near-to-zero latency.